In the 1950s and 1960s, mortgage interest rates didn’t change very much, so a typical homeowner bought a house, got a mortgage, and paid it off over 30 years. However, increased volatility of interest rates since the 1970s means that it is profitable to refinance your mortgage when the mortgage interest rate declines. Certainly, people who bought their homes in the 1980s when interest rates were above 10 percent should have refinanced their mortgage loans at some point. It only takes a small decline in the mortgage interest rate to make refinancing worthwhile. The difference in rates has to make a big enough difference in your monthly payments to make it worth the time, effort, and expense to refinance.

Almost everyone who took out a mortgage before 2009 could have profitably refinanced in 2011, 2012, or 2013. Mortgage interest rates dropped substantially from 2009 to 2013, so a homeowner is certain to pay less by getting a new mortgage than in sticking with the old mortgage. The cost of refinancing is generally about 1 percent of the total amount you are borrowing, but with a drop of 1 to 2 percentage points in the mortgage interest rate, refinancing will pay for itself within a year. So, why doesn’t everyone refinance? Part of the reason is that in the financial crisis, the value of many homes declined sharply, and banks will not refinance a mortgage loan for more than the home is worth. These days, banks are generally willing to only refinance your mortgage up to 80 percent of the home’s value, so the decline in home prices means that many homeowners will not be able to refinance their mortgages.

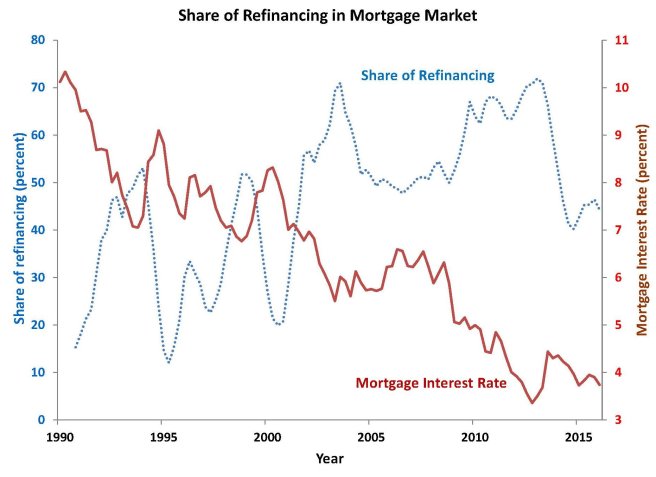

Given the ability of homeowners to refinance their mortgages, you can see why the percentage of the mortgage market that represents refinancing of existing mortgages (compared with financing new mortgages) rises as the mortgage interest rate declines. This relationship is shown in the chart. The blue dotted line shows that refinancing as a share of all mortgage loans is sometimes as low as 12 percent and as high as 72 percent. As the mortgage interest rate declined from 11 percent in 1990 to 3.5 percent in early 2013, the share of refinancing in the mortgage market generally increased. Whenever the mortgage interest rate rises appreciably, as it did in 1994, 1999, 2005, and mid-2013, you see that refinancing activity drops. And when the mortgage interest rate declines, many people refinance their homes and the market share of refinancing rises.

Chart: Share of Refinancing in Mortgage Market

Source: Federal Reserve Board data on 30-year conventional mortgage interest rate, Mortgage Bankers Association share of refinancing

When I was doing mortgages, the one thing I kept in mind for my client’s well-being is that interest rate isn’t the only factor. My company was able to refinance at any increment (1 yr. Increments), thus it was important to show actual savings based on how much they have already paid off compared to resetting their mortgage – most commonly 30 year fixed – to only save 100 bps. If the client paid 11 years off their 30 yr term, we could refinance for 19 years at a lower rate. It may not be the lowest available, but it made sense to those that wanted to take true advantage of the realized rate. In the long-run, they would be throwing equity out the window if they didn’t do so. Point being, sometimes a monthly savings of a hundred or so isn’t worth reinstating a 30 year mortgage.

LikeLike